pay personal property tax richmond va

Taxpayers can either pay. Jun 1 2022 0608 PM EDT.

Taxes Mr Williamsburg Revolutionary Ideas On Real Estate Hampton Roads Virginia

804-768-8649 Administration Individual Personal Property Income Tax Tax Relief 804-796-3236 Business License Business Tangible Personal Property Hours Monday - Friday 830 am.

. Residents of Richmond Virginia now have a new and convenient way to pay their real estate and personal property taxes with Invoice Cloud. View important dates for current supplements and due. You can call the Personal Property Tax Division at 804 501-4263 or visit the Department of Finance website.

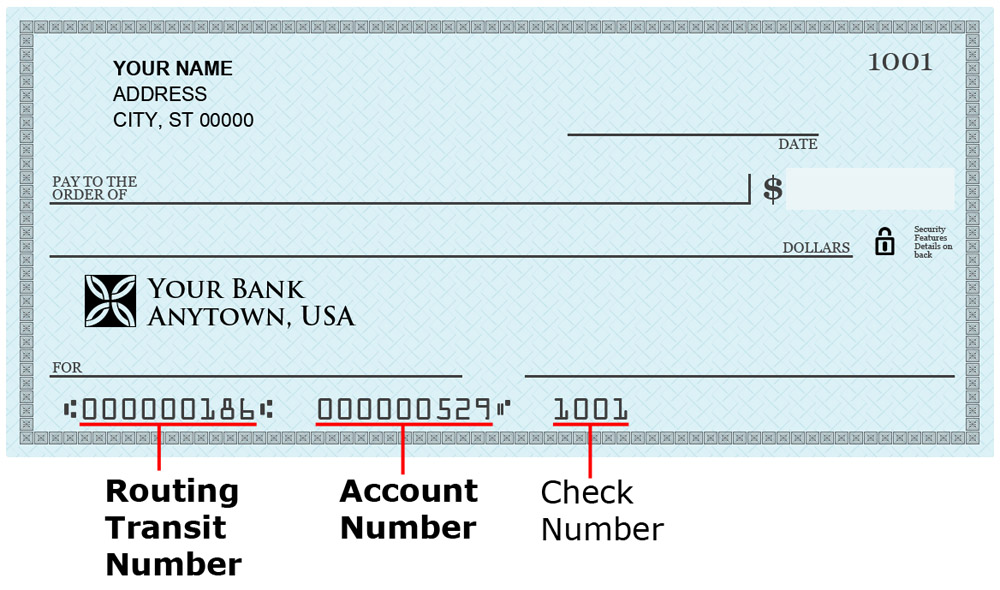

Payment of Property Tax with Credit Card. Option 1 Option 1 remains a free payment. To pay the current Personal Property bill only or to add a bill using another Web application press the Checkout button.

WRIC Richmond residents will have an extra two months to pay their personal property taxes after the City. When do I need to file a personal property return for my car or pickup. Pay all business taxes including sales and use employer withholding corporate income and other miscellaneous taxes Payment Options Based on the type of payment s you want to make you.

To create an online payment of the Richmond property tax bill we must select the Proceed to Payment option in the Inquiry section. If the information shown is incorrect press the Return to Search button. Personal Property Taxes are assessed on any vehicle motorcycle boat trailer camper aircraft motor home or mobile home owned and registered as being garaged in Richmond County as.

Supplement bills are due within 30 days of the bill date. PAY YOUR PERSONAL PROPERTY TAXES ONLINE OR BY MAIL Personal property tax bills have been mailed are available online and currently are due June 5 2022. Debit and credit cards e-checks.

Our city requires you to pay taxes on personal property real estate taxes invoices parking tickets and storm water fees. Personal Property Taxes are due semi-annually on June 25th and December 5th. You can pay your personal property tax online with an electronic check by using our Easy Check program which offers two convenient options.

Single taxpayers who earn less than 75000 a year and couples who file jointly and make less than 150000 a year will receive 350 per taxpayer and another 350 if they. The Online Payment FAQ can be found here. Land Preservation Tax Credit Land Preservation Tax Credit Land Preservation Credit Affidavit Requirements Transferring a Land Preservation Tax Credit Land Preservation Credit Appraisers.

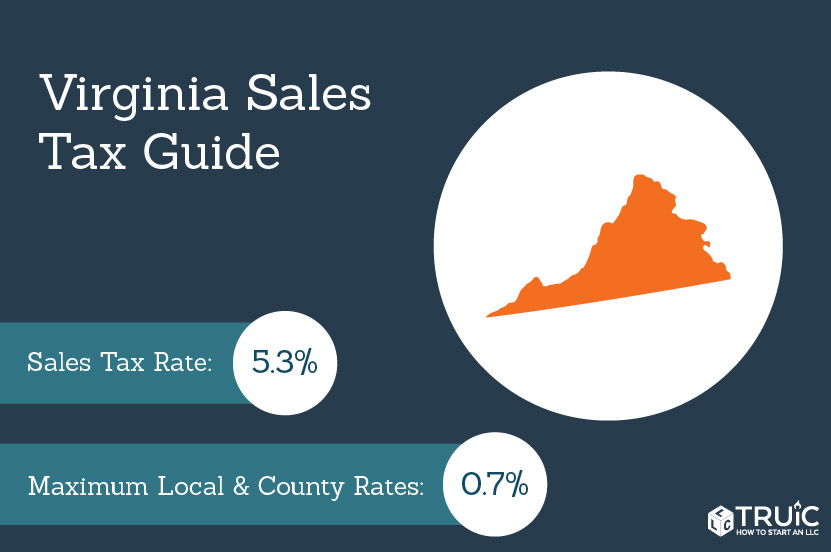

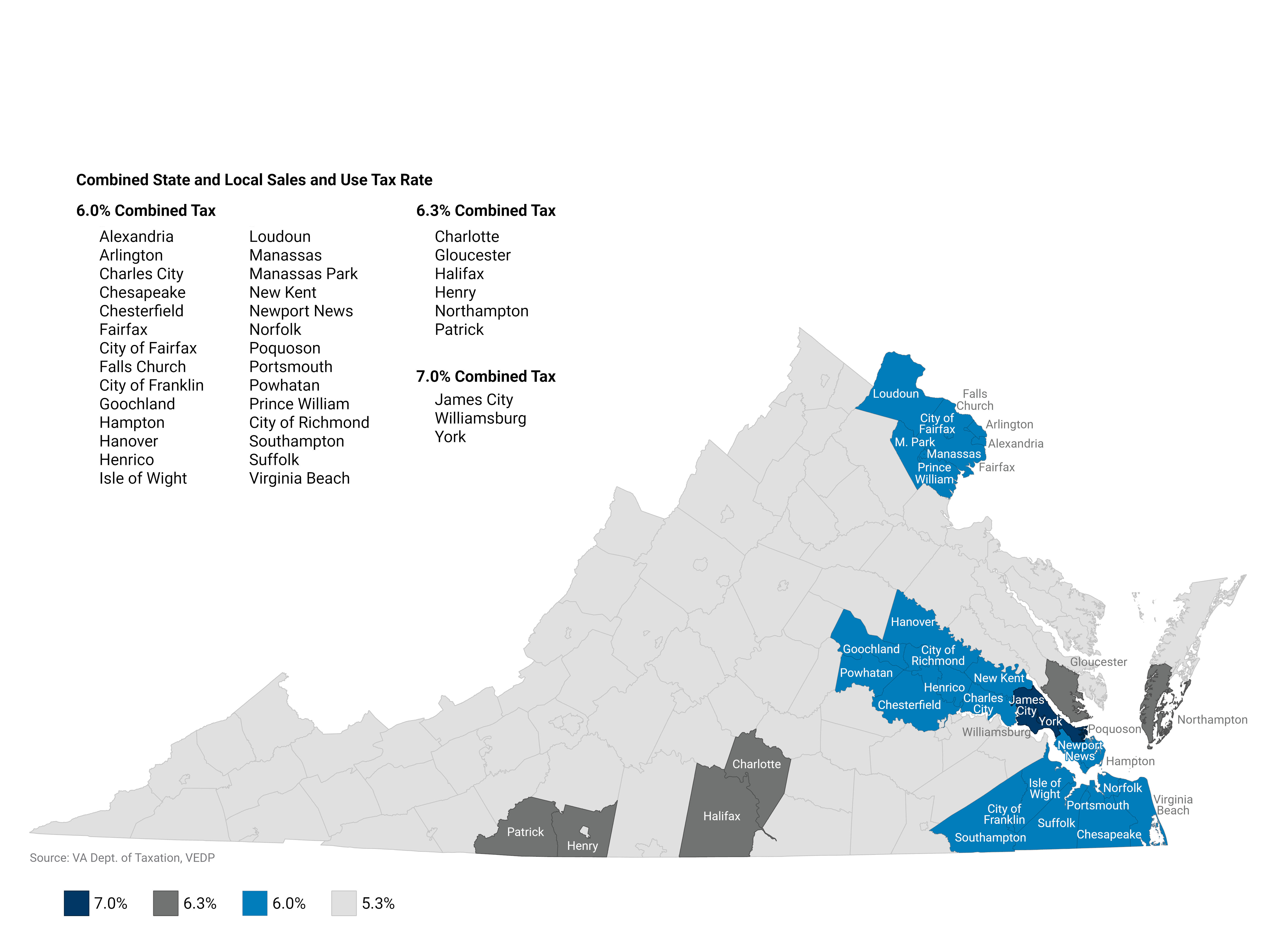

Virginia Sales Tax Small Business Guide Truic

Occupational Employment And Wages In Richmond May 2021 Mid Atlantic Information Office U S Bureau Of Labor Statistics

/cloudfront-us-east-1.images.arcpublishing.com/gray/4ASPKZIKKZEKDBCSG3BYAZNXBM.jpg)

Richmond Personal Property Tax Payment Deadline Extended Until Aug 5

The 10 Best Memory Care Facilities In Richmond Va For 2022

Frequently Asked Questions Faq King County

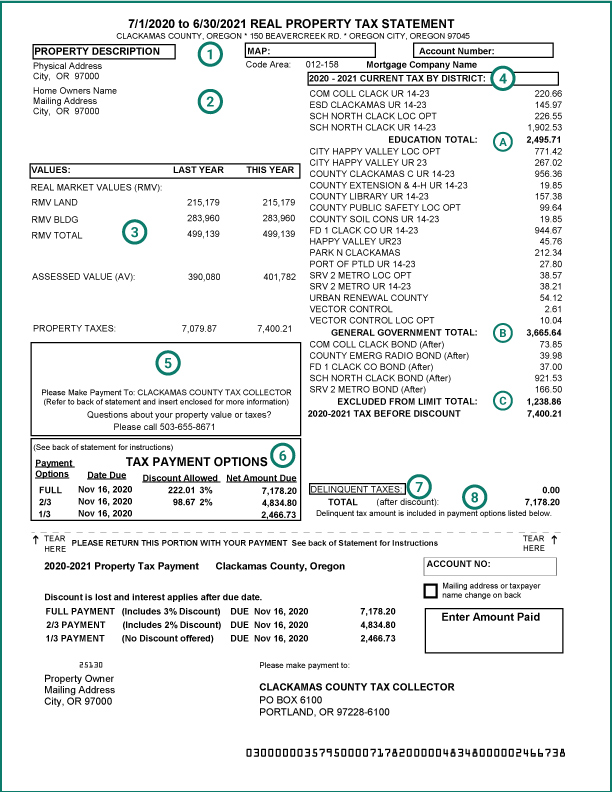

Understanding Your Property Tax Bill Clackamas County

Virginia Property Tax Calculator Smartasset

Wright Family Personal Property Tax Lists 1782 1850 Amherst County Virginia Grant Robert N 9780788446313 Amazon Com Books

Commercial And Industrial Sales Use Tax Exemption Virginia Economic Development Partnership

/cloudfront-us-east-1.images.arcpublishing.com/gray/35WKK74XNNGY7LV6OSEMVM5SXM.jpg)

12 Investigates Personal Property Tax Late Fees

Orange County Tax Administration Orange County Nc